PM Jeevan Jyoti Bima Yojana 2024 Application Form

pm jeevan jyoti bima yojana form 2024 application form pdf download pmjjby claim form download online application form eligibility criteria how to claim for insurance cover amount पीएम जीवन ज्योति बीमा योजना फॉर्म 2023

PM Jeevan Jyoti Bima Yojana 2024

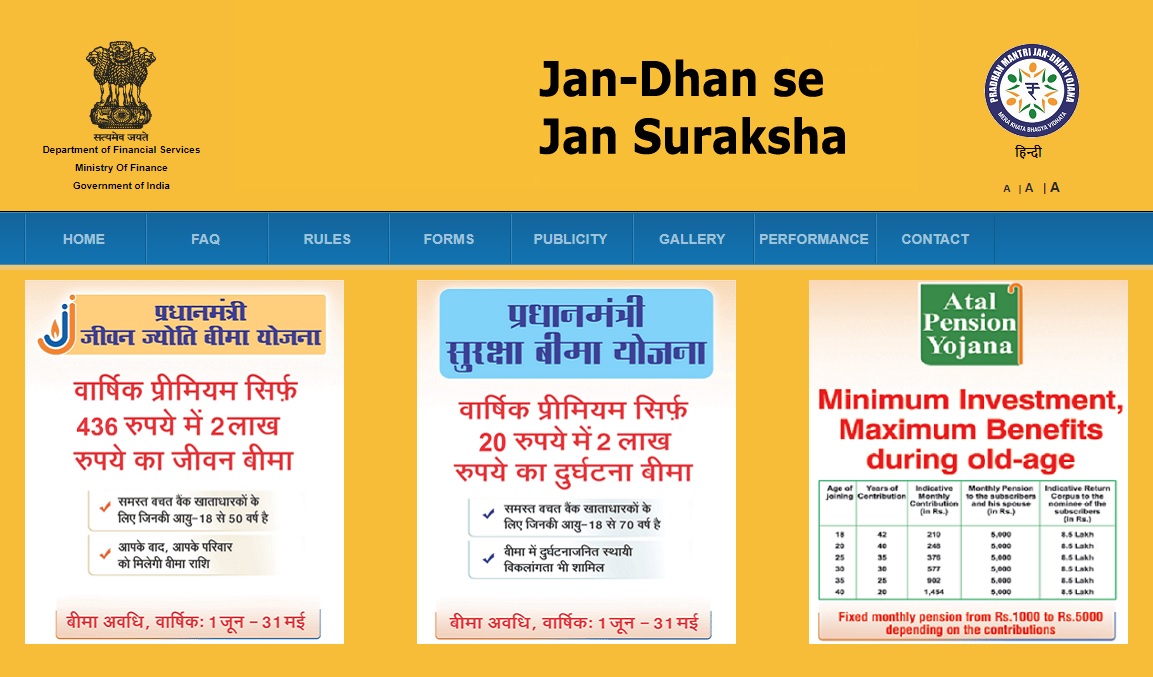

Many schemes are run by the Government of India to provide benefits to the citizens, one such scheme has been started by the Government of India, whose name is Pradhan Mantri Jeevan Jyoti Bima Yojana, this scheme was started through Life Insurance Corporation of India and other private and public sector banks. Under the Pradhanmantri Jeevan Jyoti Bima Yojana, if an applicant dies due to any reason before the age of 55 years, then the government will provide life insurance of ₹ 200000 to his nominee.

pm jeevan jyoti bima yojana 2024 application form

To take a policy plan under this plan, the minimum age of the citizens should be 18 years and the maximum age should be 50 years. The age of maturity of this policy is 55 years. Pradhan Mantri Jeevan Jyoti Bima Yojana is a very good initiative of the Government of India, due to this, not only the poor and underprivileged people will get insurance, but their children will also get a lot of money from this scheme in future. The interested beneficiaries of this Pradhanmantri Jeevan of the country If you want to take advantage of Jyoti Bima Yojana, then they have to apply under this scheme.

Also Read : Rail Kaushal Vikas Yojana

Revision made in the amount of premium under the scheme

The premium rates of Pradhan Mantri Jeevan Jyoti Bima Yojana have been revised by the Central Government on 31 May 2022. The decision to increase the premium rates of this scheme has been taken in view of the long standing experience of adverse claims. Now under this scheme the beneficiaries will have to pay a premium of ₹ 1.25 per day. Under which now the premium amount will increase from ₹ 330 to ₹ 436 per month. This scheme was launched in 2015. There was no revision in the premium rate under this scheme in the last 7 years. As on 31 March 2022, the number of active customers under this scheme has been recorded as 6.4 million.

Purpose of Pradhan Mantri Jeevan Jyoti Bima Yojana

This is a very good scheme for the people of the country who want to provide social security to their family even after their departure. Under the scheme, the amount of Rs 2 lakh given by the government will be given to the family of the policy holder. So that he can lead his life well. Through this scheme, Indian citizens have to be covered with PMJJBY. Through this scheme, not only the poor and deprived sections will get insurance.

Pradhan Mantri Jeevan Jyoti Bima Yojana Exit

Any person who has exited from Jeevan Jyoti Bima Yojana can rejoin this scheme. To rejoin the Pradhan Mantri Jeevan Jyoti Bima Yojana, the premium amount has to be paid and a health-related self-declaration has to be submitted. Any person can re-adroll to this plan by paying the premium and submitting a self-declaration.

Under what circumstances will the benefit of this scheme not be provided

- If the beneficiary’s bank account has been closed.

- In case of non-availability of premium amount in the bank account.

- On completion of 55 years of age.

Benefits of Pradhanmantri Jeevan Jyoti Bima Yojana

- Citizens of 18 to 50 years of the country can take advantage of this scheme.

- Under this scheme, after the death of the policy holder, the family of the policy holder can be renewed PMJJBY under this scheme year after year. The member of this plan has to pay an annual premium of Rs 330. Life insurance of Rs 2 lakh will be provided.

- To take advantage of PMJJBY, the applicant has to apply under this scheme.

- The annual installment under this plan is paid before 31st May during each annual coverage period.

- If the annual installment could not be deposited before this date, the policy can be renewed by paying the entire annual premium in lump sum along with self-declaration of good health.

Some Key Features of Jeevan Jyoti Bima Yojana

- You do not need to undergo any kind of medical examination to buy Pradhan Mantri Jeevan Jyoti Bima Yojana.

- To buy PM Jeevan Jyoti Bima Yojana, your minimum age should be between 18 years to 50 years.

- The maturity age of PMJJBY is 55 years.

- This plan has to be renewed every year.

- The sum insured under this scheme is ₹ 200000.

- The enrollment period of Pradhan Mantri Jeevan Jyoti Bima Yojana is from June 1 to May 31.

- Cannot claim for 45 days after getting Android. You can file a claim only after 45 days.

PM Jeevan Jyoti Bima Yojana Termination

The assurance on the life of the member can be terminated for any of the following reasons.

- In case of closure of account with the bank.

- In case of non-availability of premium amount in the bank account.

- On attaining the age of 55.

- A person can take Pradhan Mantri Jeevan Jyoti Bima Yojana from only one insurance company or from only one bank.

Also Read : Seekho Aur Kamao Yojana

Eligibility of Pradhan Mantri Jeevan Jyoti Bima Yojana

- The age of the citizens taking the policy under this scheme should be 18 to 50 years only.

- Under this tram plan, the policy holder will have to pay a premium of Rs 330 per year.

- It is mandatory for the policyholder to have a bank account under this scheme. Because the amount given by the government will be directly transferred to the beneficiary’s bank account.

- The subscriber has to maintain the required balance in the bank account at the time of auto debit on or before 31st May every year.

Documents of Jeevan Jyoti Bima Yojana

- Applicant’s aadhar card

- Identity card

- Bank account passbook

- Mobile number

- Passport size photo

How to apply for Pradhan Mantri Jeevan Jyoti Bima Yojana?

Interested beneficiaries of the country who want to apply to get the benefits of Jeevan Jyoti Bima Yojana, then they should follow the method given below.

- First of all you have to go to the official website of Public Safety https://www.jansuraksha.gov.in/.

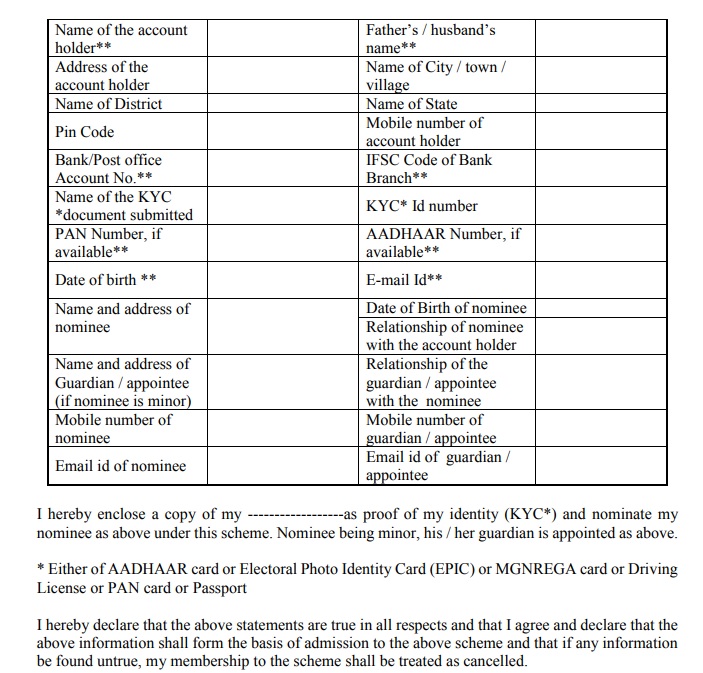

- You have to download the PMJJBY Application Form PDF by visiting the official website. After downloading the PDF, you will have to fill all the information asked in the form.

pm jeevan jyoti bima yojana 2024 application form

- After filling all the information, you will have to deposit it in the bank where your active savings bank account will be opened.

- You have to make sure. That you have sufficient balance in the account to pay the premium.

- After this, submit a consent letter to join the scheme and auto-debit the premium amount. Attach the consent document with the duly filled application form.

- Application Form or Consent-cum-Declaration Form for Pradhan Mantri Jeevan Jyoti Bima Yojana can be downloaded from the official website in the desired language at the link given below.

How to claim for Pradhan Mantri Jeevan Jyoti Bima Yojana?

- After the death of the person who has been insured, then his nominee can claim under Jeevan Jyoti Bima Yojana.

- After this, first of all, the nominee of the policy holder should contact the bank.

- Then the nominee will have to take the Pradhan Mantri Jeevan Jyoti Insurance Claim Form and Discharge Receipt from the bank.

- Then the nominee will have to submit the claim form and discharge receipt form along with photographs of death certificate and canceled cheque.

Helpline Number : 18001801111 / 1800110001

| Like on FB | Click Here |

| Join Telegram Channel | Click Here |

| For Help / Query Email @ | [email protected]

Press CTRL+D to Bookmark this Page for Updates |

If you have any query related to PM Jeevan Jyoti Bima Yojana then you can ask in below comment box, our team will try our best to help you. If you liked this information of ours, then you can also share it with your friends so that they too can take advantage of this scheme.