Stand Up India Loan Scheme 2024 Apply Online

stand up india loan scheme 2024 apply online for women and SC/ST, know complete details such as application process, interest rates, eligibility criteria & features of stand up India loan scheme स्टैंड अप इंडिया लोन स्कीम 2023

Stand Up India Loan Scheme 2024

In India, challenges have always plagued entrepreneurs who are women or are members of the SC/ST community who are looking to obtain a loan to launch their own business venture. However, in a noble effort to not only acknowledge but also address these challenges, faced by members of the SC/ST communities and women, Prime Minister Narendra Modi launched the Stand Up India Scheme in April of 2016.

stand up india loan scheme 2024 apply

The Government of India has launched a Stand Up India Loan Scheme. Under this scheme, bank loans are provided to scheduled caste, scheduled tribe, and women borrowers. These bank loans will range from Rs 10 lakh to Rs 1 crore. With the help of this scheme at least one scheduled caste or scheduled tribe borrower and at least one woman borrower per bank branch will be provided a loan for setting up a Greenfield Enterprise. This enterprise can be a manufacturing, service, Agri allied activity, or trading sector.

This scheme has been launched in order to facilitate SC/ST and women entrepreneurs in setting up enterprises, obtaining loans, and providing other support which is needed from time to time. Under this scheme, all the branches of scheduled commercial banks will be covered directly at the branch or through SIDBI stand-up India portal through the lead district manager.

Also Read : Samridh Scheme

Objective Of Stand Up India Loan Scheme

The main objective of the Standup India loan scheme is to provide financial support for setting up Greenfield Enterprise. Through this scheme financial support from Rs 10 lakh to Rs 1 crore is provided to SC, ST or women entrepreneurs. With the help of this scheme SC, ST, and women entrepreneurs will be facilitated in setting up enterprises, obtaining loans, and getting other support that is needed from time to time. Other than that through this scheme employment will be generated which will reduce the unemployment rate. Nearly 2.5 lakh beneficiaries will be benefited through 1.25 lakh banks under the stand-up India loan scheme.

Required Details While Providing Loan

- Location of Borrower

- Category

- Nature of business

- Availability of place to operate business

- Assistance needed for preparing a project plan

- Requirement of skills and training

- Details of bank account

- Amount of own investment into the project

- Whether help is needed to raise margin money

- Any previous experience in the business

Based on the above details the portal categorizes the borrower as a ready borrower or trainee borrower.

Features of Stand Up India Loan Scheme

- Nature of loan – The loan provided under this scheme is a composite loan which includes a term loan and the working capital.

- Availability of Scheme – This scheme will be provided by all Scheduled commercial bank branches and can be accessed either directly at the bank branch, via SIDBI’s Stand Up India portal or via the Lead District Manager.

- Quantum of loan – The loans provided under this scheme will range between the amounts of Rs 10 lakh and up to Rs 1 crore. the composite loan amount will cover 75% of the cost of the project. This includes the amount of working capital and the term loan. However, the condition that the loan shall cover 75% of the cost of the project will not be applicable in case the contribution of the borrower, along with financial support being provided from any other scheme amounts to more than 25% of the overall cost of the project.

- Purpose of loan – The loan will be provided to any woman, SC or ST entrepreneur who is undertaking a venture for the first time under the services, trading or manufacturing sector.

- Rate of Interest – The Stand Up India scheme interest rate shall be the lowest interest rates which are offered by the bank for the particular category. The interest rate however must not exceed the Tenor premium + 3% + MCLR.

- Security for loan – In addition to primary security, the loan may require the applicant to provide collateral security or a guarantee of CGFSIL (Credit Guarantee Fund Scheme for Stand Up India Loans), as is required by the bank.

- Repayment of loan – The maximum tenure allowed for repayment of loans taken under this scheme is 7 years, along with a moratorium period of 18 months.

- Working Capital – For the purpose of drawing working capital up to an amount of Rs 10 lakh, the funds will be sanctioned in the form of overdrafts. A RuPay debit card can also be issued to the borrower for added convenience of withdrawing funds easily. If the working capital required is above Rs. 10 lakh, the same will be provided by cash credit limit.

- Margin Money – While this scheme operates under the assumption that 25% of the margin money for the project will be provided by other state/central government schemes which provide subsidies, the loan applicant is expected to contribute a minimum of 10% of the cost of the project from their own funds.

Eligibility for Stand Up India Loan Scheme

In order to be eligible for obtaining a loan under the Stand Up India Loan scheme, an individual must comply with the following eligibility criteria:

- The individual must be above 18 years of age.

- The entrepreneur must either be a woman or belong to the SC or ST community.

- Loans will be provided under this scheme only for funding green field projects, which implies that the venture is the very first one ever being undertaken by the applicant under the trade, services or manufacturing sector.

- If the loan is being taken for a non-individual enterprise, then it is compulsory that a minimum of 51% of the shareholding / controlling stake be held by a woman, SC or ST entrepreneur.

- The loan applicant must not be an existing defaulter to any bank or financial organization.

Also Read : PM Poshan Shakti Nirman Yojana

Types Of Borrowers Under Stand Up India Loan Scheme

- Ready borrower– If the borrower does not require any handholding support then that borrower will be considered as ready borrower. This borrower can start the process of application for loan at the selected Bank. After application the borrower will get the application number and the information about the borrower will be shared with the bank LDM and the relevant link office of NABARD and SIDBI. After that loan application will be generated and tracked through portal

- Trainee borrower– If the borrower requires handholding support, that borrower will be considered as trainee borrower. NABARD and SIDBI will arrange for support for the trainee borrower in the form of financial training, skilling, margin money mentoring, support utility,connection etc. Other than that the LDM will also monitor the process of work with local offices of SIDBI and NABARD in order to solve problems and easing bottlenecks. After adequately meeting the hand holding requirements and attaining the satisfaction of LDM and the trainee borrower the loan application will be generated through the portal.

Stand Up India Loan Scheme Margin Money And Grievance Redressal

- Under the scheme 15% margin money will be envisaged

- The borrower is required to invest at least 10% of the project cost as own contribution

- If the state scheme supporting the borrower with 20% of the support cost as subsidies then the borrower is required to contribute at least 10% of the project cost

- The district level credit committee will be responsible for implementing this scheme

- Various kinds of events will be organised at the district level which involve stakeholders of the scheme in order to guide potential entrepreneurs

- These event will guide the the entrepreneurs in making registrations

- SIDBI will provide support for organisation of these events

- The grievances of the borrower will also be addressed

- The portal provides contact details of various officers who will attend to the grievances

- Soon an online process for submission of complaints and subsequent tracking through the portal will be developed

- Other than that feedback on disposal of complaint will be made available by the customers

Apply For Loan Under Stand Up India Loan Scheme

- First of all go to the official website of Stand up India loan scheme https://www.standupmitra.in/

- On the homepage click on Click Here for Handholding support or Apply for a loan option.

stand up india loan scheme 2024 apply

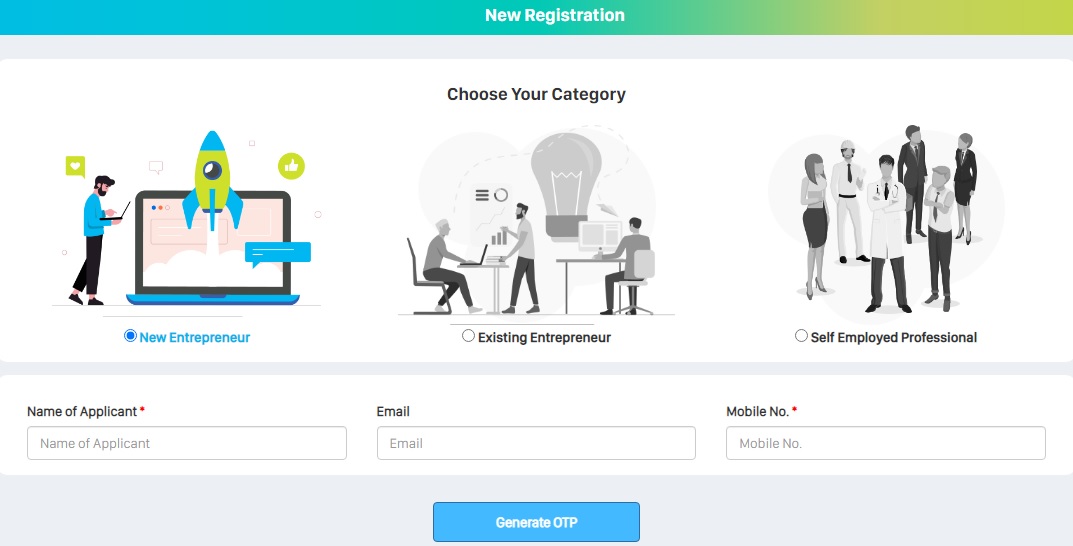

- A new page will appear before you

- On this new page you have to choose your category

- After that you have to enter your name email address and mobile number

- Now you have to click on Generate OTP

stand up india loan scheme 2024 apply

- After that you have to enter OTP into the OTP box

- Now you have to click on Register

- After that you after click on login

- Now you have to enter your login credentials and click on login

- Now click on stand up India loan scheme option.

- Application form will appear before you

- You have to enter all the required details in this application form

- Now you have to enter all the required documents

- After that you have to click on submit

- By following this procedure you can apply under stand up India loan scheme

Contact Information

- Email:- support[at]standupmitra[dot]in help[at]standupmitra[dot]in

- National Helpline Toll free Number:-1800-180-1111

| Like on FB | Click Here |

| Join Telegram Channel | Click Here |

| For Help / Query Email @ | [email protected]

Press CTRL+D to Bookmark this Page for Updates |

If you have any query related to Stand Up India Loan Scheme then you can ask in below comment box, our team will try our best to help you. If you liked this information of ours, then you can also share it with your friends so that they too can take advantage of this scheme.